Tax Credit

Hope haven is a qualified domestic violence shelter!

Tax Credit Application

Hope Haven is a 501(c)3 Charitable Organization

70% of your donation will go toward your tax liability (total tax owed)

& receive your charitable donation deduction

What is a Tax Credit?

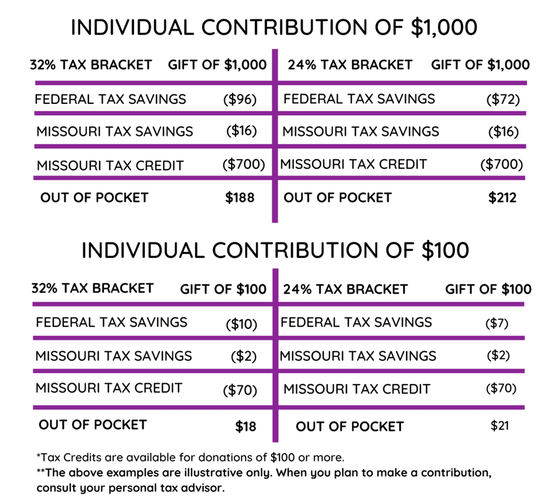

A tax credit is a sum subtracted from the total amount a taxpayer owes to the state. Unlike deductions and exemptions that reduce taxable income, credits directly reduce taxes owed. The value of the credits is subtracted from the total amount of owed taxes. Hope Haven currently has Missouri Domestic Violence (DV) Tax Credits for up to 70% of your gift.

70% Missouri State Tax Credits Financial gifts to Hope Haven of $1,000 or more are eligible for a 70% Missouri tax credit, which is a dollar-for-dollar reduction of the Missouri state income tax you owe. For example, if you owe $700 in Missouri taxes at the end of 2022, but you receive $700 in tax credits, your net liability drops immediately to $0.

Who is Eligible for Tax Credit?

Any individual or business who pays taxes in Missouri.

What Is The Minimum Gift Amount?

Any gifts made to Hope Haven totaling $100 or more in a calendar year.

Is It Difficult To Apply And How Long Does It Take To Receive Them?

Applying for a Missouri DV Tax Credit requires you to correctly fill out less than 10 fields on the Application Form and supply proof of donation. Fill it out, sign it, mail in the original to Hope Haven – and you’re done. Once we receive the application, approve and sign it, we send it on to the State of Missouri Department of Social Services. The State then will mail credits directly to you. Please allow 2 to 3 months for this process!

What Do I Use For My Proof Of Donation?

If the donation was made by check, you must provide a copy of the front and back of the cancelled check or provide a bank statement clearly showing your name and the payment to Hope Haven. If the donation was made by credit card, you must submit a copy of your credit card statement clearly showing your name and the payment to Rose Brooks Center. You may blackout other account information. Hope Haven thank you letters are not considered proof by the State.

What If I Don’t Itemize My Deductions?

You do not have to itemize your deductions to use a Missouri Tax Credit.

Are DV Tax Credits Transferable?

Although some tax credits are salable, domestic violence tax

credits are not – making them non-transferable.

What Can Tax Credits Be Applied To?

Income (excluding withholding tax), Corporate Franchise Tax, Bank Tax, Insurance Premium Tax, Express Companies Tax.

Where Do I Send The Completed Application?

Hope Haven

Attention: Stacy Christie

200 N. Oakland St.

Harrisonville, MO 64701

Attn: Tax Credits